Foreclosure of Mortgage Securing Electronic Promissory Note Affirmed

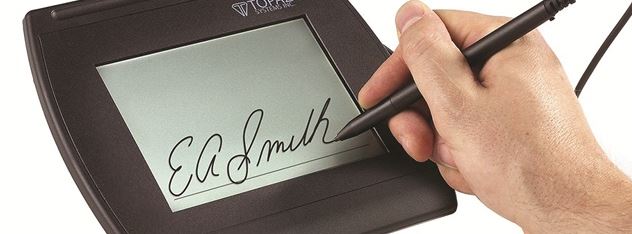

Florida’s Fourth District Court of Appeal recently issued its mandate in Rivera v. Wells Fargo Bank, N.A. confirming the finality of its decision to uphold the enforcement of an electronic promissory note (“e-note”) in a mortgage foreclosure case. The court unanimously held the servicer presented competent, substantial evidence demonstrating the e-note’s enforceability under the Uniform Electronic Transactions Act, Fla. Stat. § 668.50, et seq. (“Act”), the ownership of the e-note, and the servicer’s standing to foreclose the mortgage securing the e-note. The court also held that, pursuant to Fla. Stat. § 673.3081(1) of Florida’s Uniform Commercial Code (UCC), the servicer was not required to prove the validity of the borrowers’ electronic signatures on the e-note absent evidence that the borrowers’ signatures were forged or unauthorized.

The case emanated from the borrowers’ appeal of a final judgment of foreclosure entered in favor of the servicer as holder of the e-note. The borrowers claimed, inter alia, (i) the servicer failed to prove the e-note contained their electronic signatures, (ii) failed to prove the ownership of the e-note, and (iii) failed to prove the servicer’s authority to foreclose the mortgage securing the e-note. Pursuant to Fla. Stat. § 673.3081(1), signatures on a negotiable instrument are presumed to be authentic and authorized unless properly challenged. Because the borrowers failed to present evidence at trial that their signatures were neither authentic nor authorized, the court determined that the servicer had no obligation to prove the validity of the signatures on the e-note.

The court concluded that the e-note is a “transferable record” under the Act because it “[w]ould be a note under chapter 673 [of Florida’s UCC], or a document under chapter 677 [of Florida’s UCC], if the electronic record were in writing,” and because “[t]he issuer of the electronic record expressly . . . agreed [the e-note was] a transferable record.” In evaluating the servicer’s standing as “holder” of the e-note entitled to foreclose the mortgage, the court considered significant those provisions of the Act delineating the method for acquiring and conveying a transferable record. Control of a transferable record is established where there is a system used “for evidencing the transfer of interests in the transferable record” that “reliably establishes” the person or entity asserting control over the record is the one to which the record was issued or transferred.

For the system to meet the Act’s requirements, (1) only a “single authoritative copy of the transferable record” can exist and the authoritative copy must be “unique, identifiable, and except as otherwise provided [in the Act], unalterable;” (2) the “authoritative copy [must] identif[y] the person asserting control as the person to which the transferable record was issued or, [in the case of a transfer], the person to which the transferable record was most recently transferred;” and (3) the “authoritative copy [must be] communicated to and maintained by the person asserting control or its designated custodian.” If these requisites are established, and in the absence of an agreement to the contrary, the person or entity identified is deemed to have control of the transferable record and thereby becomes the “holder” for purposes of the UCC. Because the e-note is in electronic form, there is no requirement for delivery, possession, or indorsement of a hard copy of the e-note to enforce or exercise any rights under the Act and the UCC.

The court in Rivera determined that the servicer established the enforceability of the e-note and the servicer’s standing to pursue foreclosure because it proved, using a reliable system that complied with the Act, (i) the ownership of the e-note; (ii) the owner’s control of the e-note; and (iii) the servicer’s authority to act as the owner’s designated custodian and to foreclose the mortgage securing the e-note.

As the level of technology continues to increase, there is growing demand to transition from traditional written documents to their more contemporary electronic counterparts. Rivera is among the first U.S. opinions to recognize the enforceability of e-notes. It highlights the importance of using a reliable system to create, store, and assign interests in transferable records under the Act.