Class Actions

Overview

Carlton Fields’ class action practice team of more than 70 lawyers handles complex class actions throughout the country, at every state and federal court level, including the U.S. Supreme Court. We have defended hundreds of high-exposure class actions across a range of substantive areas, including financial services, insurance, consumer fraud, health care, real estate, antitrust, securities, product liability, toxic tort, telecommunications, tax, construction, and employment. We are familiar with virtually every issue class actions present, including the standards for class certification and strategies for defeating it, challenges to standing, jurisdiction and venue, removal, dismissal, summary judgment, arbitration, settlement administration, MDL proceedings, and joinder of parties. In the past 3 years, our lawyers have handled more than 100 active class action matters.

Our firm also has a deep understanding of the legal doctrines and laws that have particular impact on the financial services and insurance industries, including the filed-rate and form doctrines, primary jurisdiction, the McCarran-Ferguson Act, the Private Securities Litigation Reform Act, and the Securities Litigation Uniform Standards Act. Additionally, we regularly litigate removal and settlement issues related to the Class Action Fairness Act.

Early Case Assessment

The early evaluation of class action litigation is critical to efficient case planning as well as risk management. Our class action attorneys work closely with our clients to assess not only the strengths and weaknesses of the case but also to craft a litigation plan to reduce exposure and identify a set of shared objectives.

Tailored Strategies

For some clients, a vigorous challenge to class certification is critical. Others prefer strategic settlement. Still others wish us to try their cases and, if necessary, pursue appeals. In each situation, we help clients achieve their business objectives and litigation goals.

Case Management

We are frequently retained to manage or coordinate a client’s overall institutional response to multiple jurisdiction, parallel class actions, or multidistrict litigation. The skills of our class action team are supplemented by our firsthand knowledge of the risks peculiar to various jurisdictions and our significant experience in selecting and teaming with local trial counsel as appropriate.

Firmwide Resources

Our national class action defense practice team works closely with firm colleagues who focus on particular issues that arise in class action lawsuit defense. For example, they collaborate with our e-discovery team to formulate cutting-edge strategies that address the growing challenges raised by electronically stored information. They also receive crucial support from the firm’s appellate lawyers, who work alongside them before and during trial to develop the best possible record and, if necessary, to prevail on appeal.

Thought Leadership

- The firm conducts and publishes an annual national Class Action Survey, which details best practices for reducing class action costs and managing their risks. The survey draws on more than 300 in-depth interviews each year with general counsel and senior legal officers at leading companies of every size.

- Our class action lawyers contribute frequent posts to our blog, Classified, which features case summaries and links to class action-related news.

- We write and speak often on class action defense issues and trends, and have presented to clients and counsel across North America.

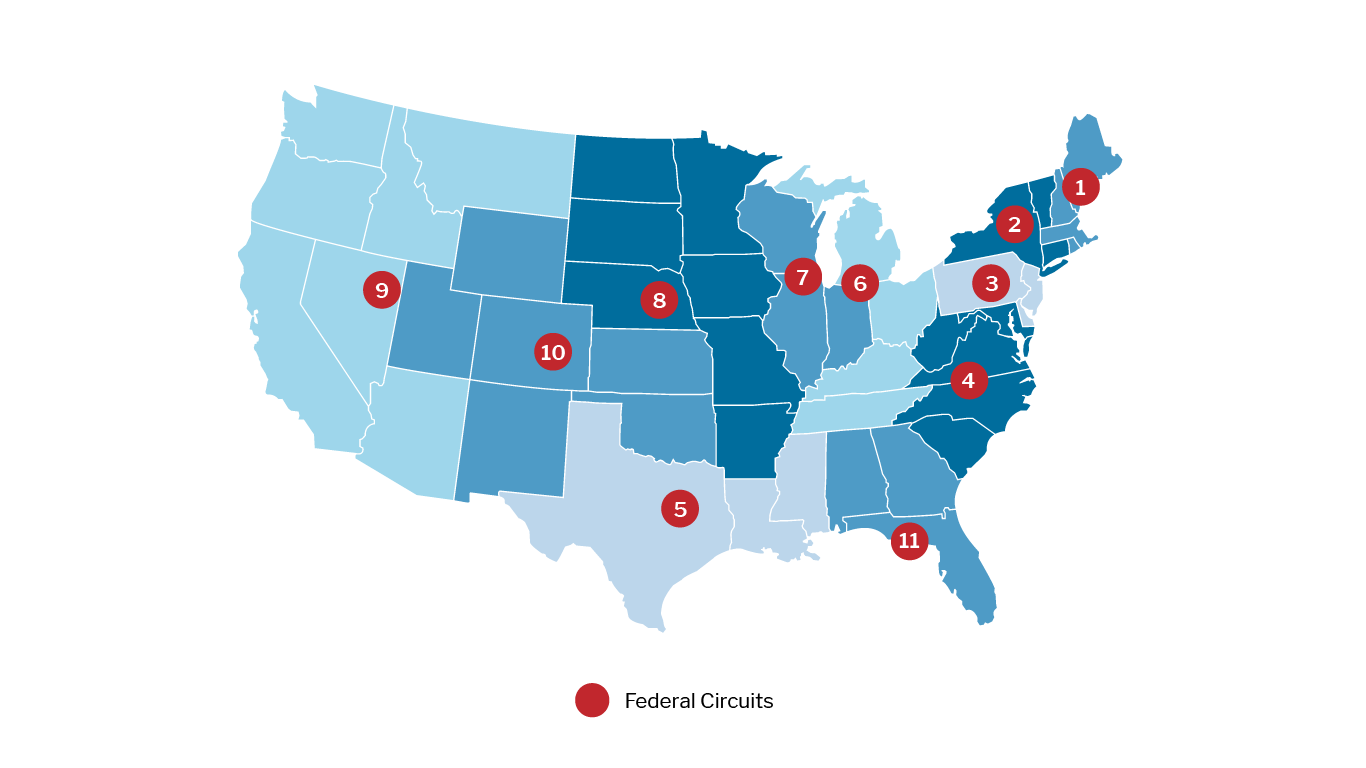

Nationwide Experience

Experience in every circuit, at every level

Carlton Fields has litigated and counseled clients in hundreds of class actions for more than 30 years in federal and state courts across the nation.

Review a list below of some of the cases we have handled in the U.S. Supreme Court, the U.S. court of appeals in every circuit, and numerous U.S. district courts, as well as in state supreme and intermediate appellate courts.

- Putative Class Action: CAFA Removal Amount In Controversy.

- Summary judgment in favor of title insurer and against certified class of refinancing borrowers who alleged they had been overcharged by not being provided reissue rates for title insurance.

- Order granting summary judgment in favor of insurer against certified class of condominium unit owners and against cross-plaintiff property developer; court finds that claims for “constructive total loss” were barred by the insurance policy’s Ordinance and Law exclusion and by failure to demonstrate compliance with city ordinance that purportedly required demolition of building.

- Challenge to policy limits for mitigation of non-hurricane water damage.

- Granting motion to stay data breach class action pending the Supreme Court's resolution of TransUnion v. Ramirez.

- Obtained dismissal with prejudice of entire seven count class action complaint seeking to quiet title to over 50,000 properties and void over 50,000 valid notes and mortgages.

In re Takata Airbag Products Liability Litigation, No. 1:15-md-02599 (S.D. Fla. 2015)

- Putative class actions for economic damages and personal injuries arising from allegedly defective airbags.

- Obtained order denying plaintiff’s motion for class certification of putative nationwide class action for breach of contract against insurer in action challenging premiums charged for a long-term care insurance policy rider.

- Putative class action against six title insurers alleging unlawful conspiracy to defraud purchasers of title insurance in Georgia by scheming to eliminate discounts from published premiums dismissed with prejudice because, inter alia, alleged misrepresentations of law are not actionable, and even if actionable, were not proximate cause of alleged injury to plaintiff.

- Order denying plaintiff's motion for national class certification in case filed by former shareholders involving alleged breaches of fiduciary duty in connection with corporate merger.

- Defense of an entity sued under the TCPA in a putative class action for sending a single unwanted text message. In a landmark decision, the Eleventh Circuit held that the plaintiff failed to allege a concrete injury sufficient to confer Article III standing, creating a circuit split on the issue.

- Enforcing class action settlement against a class member attempting to relitigate claims related to lender-placed flood insurance in a Mississippi action, and enjoined the settlement class member from further pursuing released claims in the Mississippi action.

- Order granting final summary judgment for insurer in class action involving long term care insurance claims, and the application of "Nursing Home Benefits" provisions and related Washington regulations under a long term care insurance policy.

- Motion to dismiss granted in significant part in putative class action involving insurer’s claims practices and interpretation of policy language in life and accidental death policies.

- Class action complaint alleging failure to reimburse for automobile mileage incurred while making bank deposit and a claim for penalties for the purported failure to reimburse under California’s Private Attorneys General Act of 2004 on behalf of herself and other similarly-affected employees.

- Representing industry group as amicus curiae in support of district court’s grant of motion to dismiss in ERISA class action litigation involving allegedly excessive management fees charged by 401(k) retirement plan service provider.

- Represented industry group as amicus curiae in support of prevailing party in appeal from district court's grant of summary judgment in ERISA class action involving alleged "revenue sharing" fees.

- Affirming dismissal of putative national class action alleging fraud and breach of contract regarding lender-placed insurance.

- Vacating certification of national class alleging breach of contract and the implied duty of good faith and fair dealing, bad faith, and violation of state consumer protection act, finding prior class settlement was entitled to preclusive effect.

- Denial of class certification in putative statewide consumer class action against title insurance underwriter alleging overcharging for title insurance premiums.

- Affirming dismissal of national class action collaterally attacking prior class action settlement.

- Certification proceeding stayed in putative class action alleging fraud and deceptive trade practices in connection with credit life policy. Action initially dismissed; reinstated after appeal to Fifth Circuit Court of Appeals and settled on an individual basis.

- Following motion to dismiss, plaintiff voluntarily dismiss putative class action alleging that obligor had a policy of providing incomplete refunds following the cancellation of vehicle service agreements.

- Motion to dismiss granted in putative nationwide class action against hazard insurer alleging unjust enrichment and challenging certain practices related to lender-placed insurance.

- Decertification of statewide class action for unfair trade practices based on alleged overcharging for title insurance premiums.

- Obtaining dismissal of class action brought against lender placed insurers and mortgage loan servicers alleging "illegal kickbacks" of premium charges and misappropriation of insurance proceeds based on the "filed rate" doctrine and mortgagor's lack of standing to pursue policy benefits.

- Represented private placement variable life insurer in its capacity as a financial institution class member in a nationwide class action settlement relating to alleged losses attributable to Madoff "feeder fund" investments.

- Motion to dismiss granted for insurer in putative class action alleging, inter alia, breach of contract and violations of RICO and state consumer protection statutes in connection with placement of lender-placed insurance.

- Class action challenging insurer's cost of insurance rate adjustment, granting defendant's motion for summary judgment as to breach of contract claims alleging impermissible basis for rate adjustment.

- Represented amicus curiae in case that affirmed in part the dismissal of a putative class action alleging breach of contract and breach of the implied covenant of good faith and fair dealing regarding lender-placed insurance practices.

- Represented industry group as amicus curiae in support of defendant-appellant/cross-appellee in successful appeal from district court's fiduciary liability ruling and class-wide monetary award in ERISA class action involving a group life insurer's use of retained asset accounts to pay life insurance benefits.