Property & Casualty Insurance

Overview

We provide coverage and claims counseling, litigation, and arbitration services in matters involving all types of property and casualty insurance. In addition, we defend individuals and entities that are insured by our clients under a wide range of policies. We also provide services related to issues such as claims and underwriting practices, regulatory and transactional matters, administrative and regulatory litigation, and reinsurance.

-

Directors and Officers and Related Coverages – We provide analysis and dispute resolution, and litigate a variety of claims by insureds under directors and officers (D&O) liability policies and related coverages. Our lawyers regularly handle complex coverage issues on behalf of insurers under D&O, errors and omissions (E&O), employment practices liability (EPL), and other professional liability policies.

Bad Faith Litigation – We have considerable experience handling bad faith litigation. Our lawyers represent leading insurance companies in bad faith litigation (both individual and class action) in state and federal courts throughout the country, and we devise and help implement creative strategies for minimizing or eliminating exposure to extra-contractual liability.

General Liability – We assist clients with the construction and interpretation of commercial general liability (CGL) policies, counseling them and litigating on their behalf. In this capacity, we address issues related to the duties to defend and indemnify, the scope of occurrence-based coverage, long-tail exposures and allocation, lost policies, and bad faith.

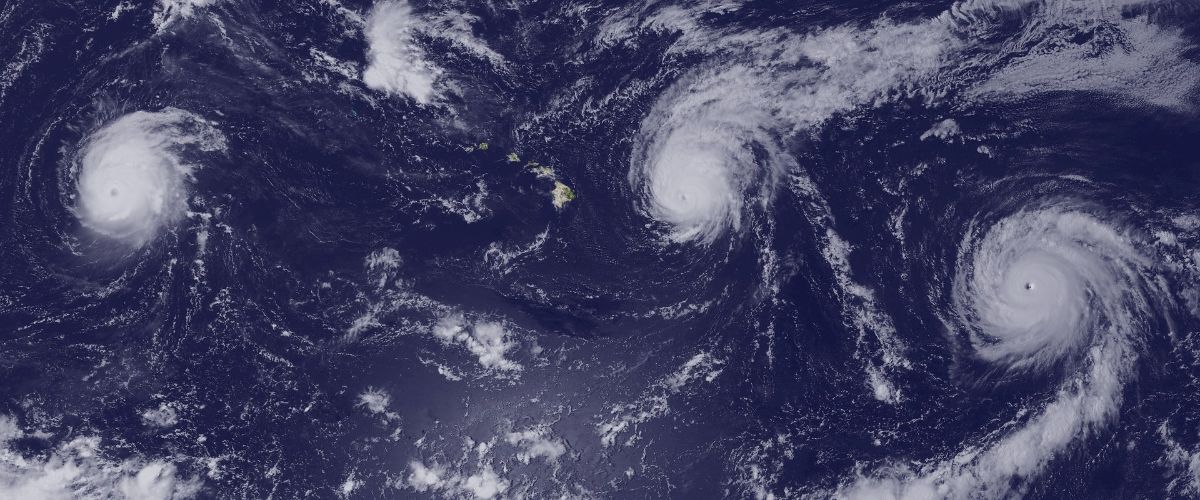

First-Party Property – Our coverage lawyers have extensive experience with first-party property insurance claims that arise from all types of losses. In complex, first-party commercial property coverage litigation, we consult on coverage issues from early in the claim adjustment process through coverage litigation. This work includes examinations under oath, appraisals, mediations, arbitrations, trials, and appeals. We handle disputes involving catastrophic losses, property damage, business interruption and other economic losses, hurricane-related losses, floods, sinkholes, construction defects, breakdown or malfunction of boilers and other critical equipment, application of sublimits, trigger of coverage, number of occurrences, and bad faith.

Merger & Acquisition Representation and Warranty Insurance – We have a sophisticated practice representing issuers of insurance for the representations and warranties that accompany merger and acquisition transactions. By combining the coverage experience of our insurance practitioners with the detailed analysis and understanding of the deal developed by our corporate securities and merger and acquisition attorneys, we bring to each claim analysis the level of critical expertise needed to evaluate these complex claims.

Excess and Umbrella – Our lawyers handle litigation over the duties of excess and umbrella carriers. These cases involve issues including the insolvency of an underlying primary insurer, the interpretation of “other insurance” clauses, the effect of an insured’s settlement without consent, the insured’s reporting obligations, the significance of a self-insured retention, “follow form” provisions, choice-of-law issues, and apportionment issues.

Environmental – On behalf of insurers and their insureds, we handle claims for environmental spills and contamination under CGL policies and specialty environmental policies. These suits involve the interpretation of both the “sudden and accidental” and “absolute” pollution exclusions, reasonable and necessary costs of cleanup, the duty to defend CERCLA claims and other pre-litigation matters, and the myriad coverage issues that frequently arise in this type of claim.

We have extensive experience with the major underwriters of policies insuring against environmental contamination. We have represented insurers in complex declaratory judgment actions regarding coverage for environmental claims under both pollution legal liability policies and construction pollution liability policies as well as claims for coverage under policies insuring underground and aboveground storage tank systems.

Our combined environmental law and litigation experience enables us to handle environmental insurance claims with a full understanding of the issues surrounding complex environmental cleanups. We have extensive experience handling issues such as industrial and domestic wastewater; storage tank regulation; and landfill, used oil, and hazardous waste permitting and regulation. We also negotiate consent orders and remediation plans associated with the cleanup of hazardous waste, petroleum, chlorinated solvents and other contaminants with local, state, and federal environmental agencies. In addition, we have extensive environmental contamination litigation experience that includes handling claims for property damage, personal injuries, and medical monitoring stemming from alleged exposure to on- and off-site contaminants.

Fidelity, Commercial Crime, and Financial Institution and Broker Bonds – Our lawyers investigate claims, analyze coverage and salvage issues, work with financial and forensic consultants to quantify damages, and represent insurers in litigation under all insuring agreements of financial institution, broker, and other theft and fidelity bonds and crime policies. We have authored multiple chapters in publications about coverage under such policies.

Construction and Surety – In construction-related matters, we regularly counsel insurers on CGL, builder’s risk, and professional errors and omissions policies. We also represent sureties in various payment and performance bond claims. This work includes helping insurers and sureties draft policy and bond language. We also address regulatory issues regarding various insurance control programs. Our lawyers are experienced in all types of construction claims including those involving termination of contractors, payment claims, delay claim analysis, construction defects, differing site conditions, and design professional liability.

Data Security and Data Privacy – Our lawyers have extensive experience handling privacy and security issues for clients nationwide. We frequently speak and write on data privacy and security law, and our privacy and security law clients operate in various industries, including insurance. We are well-positioned to provide compliance assistance regarding the privacy and security of individually identifiable data. Our lawyers are knowledgeable regarding federal and state privacy laws (e.g., Gramm-Leach-Bliley, HIPAA, CPNI), and the privacy and security standards used in various industries. We help clients draft and implement policies and procedures that will protect their sensitive data while complying with the requirements of state and federal privacy and security laws. We also help clients respond to data and security breaches. This work includes the required reporting to state and federal agencies, dealing with the implications for customers, vendors, and employees; and handling potential, related litigation.

Cyber Coverage and Disputes – Carlton Fields’ coverage team has been at the forefront of counseling and litigating cyber coverage disputes for insurers since long before data breaches made news, or stand-alone cyber coverages were developed. Carlton Fields’ coverage lawyers have handled some of the most high-profile and high-dollar cyber coverage disputes. We have counseled insurers regarding coverage for data breaches, malware attacks, political hacktivism, social engineering/phishing/spoofing schemes, and misappropriation of intellectual property. We have analyzed cyber coverage issues under traditional coverages, including CGL and fidelity policies (and particularly the “computer systems fraud” rider), as well as newer cyber-specific package policies, that include first-party coverages, such as data restoration and replacement, business interruption, and breach response costs, as well as third-party liability coverages, including security and privacy liability, derivative vendor and contractual liability, and internet media liability.

-

Corporate Officers and Governance – We regularly defend individuals and entities that are insured by our clients under D&O, E&O, EPL, policy legal liability, fiduciary liability, and miscellaneous professional liability policies. We handle high-risk matters of all types, including class actions, multidistrict litigation, adversary proceedings in bankruptcy, and all stages of disputes, from pre-litigation counseling through appeal.

Our experience includes handling claims involving the Telephone Consumer Protection Act and data privacy. We routinely defend insureds and their employees, directors, and officers against claims for securities fraud, breach of fiduciary and other duties imposed on corporate officers, discrimination, harassment and other violations of state and federal civil rights statutes, whistleblowing and retaliation, interference with business and contractual relations, unfair trade practices, fraud, and defamation. Our cases often arise in the context of disputes over corporate governance, including those between majority and minority shareholders.

We also defend insureds in ERISA cases. Numerous attorneys authored chapters in the Handbook on ERISA Litigation, published by Aspen Law & Business.

-

Claims Practices – We handle national and state class actions and individual lawsuits arising out of claims practices and procedures. These matters include disputes over the use of electronic systems and databases to help process claims under automobile, homeowners, and workers compensation insurance policies; premium reporting practices as related to residual market obligations; the use of consumer credit information for claims investigations; medical records handling in workers compensation claims; implementing agreements with preferred provider organizations and direct repair programs; enforcing conditions on full replacement cost and “ordinance or law” coverage; calculating general contractors’ overhead and profit; and calculating reimbursements under medical payments coverages. In other cases, we have represented third-party administrators in disputes over claims handling, and counseled them on information technology and data privacy issues.

Our lawyers also counsel claims organizations on the design and implementation of claims practices and procedures. We have helped manage communications and negotiated contract terms with vendors of claims-processing products. We have represented insurers in disputes with those vendors and in disputes with medical device manufacturers over fraudulent billing and referral practices.

Underwriting Practices – We represent clients in class action and individual litigation involving the use of consumer credit information for underwriting and marketing purposes, nonrenewal and termination of property and liability policies, actual and alleged misrepresentations by brokers and agents, sale of lender-placed property insurance, reformation of policies, enrollment of residential tenants on surety bonds, underwriting requirements for surplus lines policies, and insurers’ obligations to lienholders and additional insureds. We also provide training to underwriters and staff on complex issues of environmental law, and on regulatory developments that may impact underwriting environmental riders.

In addition, we help design protocols for compliance with the notice requirements of the Fair Credit Reporting Act.

Regulatory & Transactional Counseling – Our lawyers have significant experience representing property and casualty insurance and reinsurance clients in regulatory matters before departments of insurance in the U.S. and several non-U.S. jurisdictions (e.g., Bermuda and United Kingdom). Our services encompass the full range of regulatory issues faced by insurers, reinsurers, and other regulated entities within the insurance and reinsurance industry.

We handle matters involving insurer and reinsurer financial condition and solvency; ratemaking; company licensing; registration and approval of new products; approval of formation, acquisition or merger of insurers and reinsurers; insurer examinations, including market conduct examinations; surplus lines issues; reinsurance issues; receivership matters; insurance tax issues; and producer licensing and regulation.

We also have significant experience in administrative and other regulatory litigation, including agency rule challenges, regulatory investigations under state and federal false claims acts and unfair trade practice statutes, and defending clients in related individual and class action civil suits. In addition, we counsel and defend insurer clients regarding protection of trade secrets in connection with regulatory filings and disclosure under state public records laws.

We represent property and casualty insurance and reinsurance clients in the formation, acquisition, and disposition of insurance companies, reinsurance companies, captives, and related entities, and handle all regulatory aspects of reporting or seeking approval of such transactions with state insurance regulators. Additionally, we provide advice and counsel concerning producer and third-party contracts.

Reinsurance – We provide a broad range of services to property and casualty insurers and reinsurers. These services include representing cedents and reinsurers in litigation or arbitration arising from claims, underwriting, or other issues; providing coverage advice to cedents or reinsurers; representing ceding insurers in catastrophe bonds; negotiating and documenting reinsurance transactions; reviewing reinsurance contracts; advice and counsel on fronting arrangements; captive insurers; reinsurance claims monitoring; and representing reinsurers in insurer insolvency proceedings.

Experience

General Property and Casualty

- Harbour House (Bal Harbour) Condo. Ass'n, Inc. v. Am. Int'l Specialty Lines Ins. Co., No. 15-28921 (Fla. Cir. Ct. 2016) (obtaining pre-answer dismissal of coverage action involving alleged property damage claims).

- Carfax Inc. v. Illinois Nat'l Ins. Co., No. 655198/2016 (N.Y. App. Div.). On March 1, a New York appeals court ruled that Carlton Fields client American International Group Inc. (AIG) need not defend Carfax Inc. against a $50 million suit alleging the company monopolized the vehicle history report market. The decision affirmed the lower court’s determination that the matter did not fall within the insuring agreement and that, even if it did, it would be precluded from coverage based on the application of the policy’s antitrust exclusion.

- Langdale Co. v. Nat'l Union Fire Ins. Co. of Pittsburgh, 110 F. Supp. 3d 1285 (N.D. Ga. 2014), aff’d, 609 F. App'x 578 (11th Cir. 2015) (trial and appellate counsel for directors and officers liability insurer in suit for coverage by closely held entity seeking $10 million in defense costs as well as penalties for bad faith for suit by minority shareholders for fraud in the sale of securities; obtained summary judgment that was upheld on appeal).

- Weitz Co. v. Lexington Ins. Co., 982 F. Supp. 2d 975 (S.D. Iowa 2013), aff’d, 786 F.3d 64 (8th Cir. 2015). As the lead defense firm in the Southern District of Iowa, obtained a defense summary judgment where the plaintiff general contractor improperly attempted to obtain a $50 million-plus double recovery in equity against a project owner’s post-construction property insurers. The general contractor was previously sued for its materially deficient construction of the project in the Southern District of Florida. It settled with the project owner after recovering several million dollars more from its liability insurers, subcontractors, and their liability insurers. As part of the appellate team in the Eighth Circuit Court of Appeals, we defended entry of this summary judgment on appeal and obtained affirmance.

- Office Depot, Inc. v. Nat'l Union Fire Ins. Co. of Pittsburgh, 734 F. Supp. 2d 1304 (S.D. Fla. 2010), aff’d, 453 F. App'x 871 (11th Cir. 2011). Summary judgment in favor of insurer on insured’s claims of more than $24 million in investigation costs.

- Am. Safety Indem. Co. v. Sto Corp., 802 S.E.2d 448 (Ga. Ct. App. 2017) (appellate counsel to insurance company in action alleging coverage by estoppel due to alleged failure to provide adequate notice of reservation of rights in defense of underlying action and statutory bad faith).

Insurance Coverage, Monitoring and Bad Faith

- Cty. of Suffolk v. Lexington Ins. Co., No. 604661/2017 (N.Y. Sup. Ct. 2018) (obtaining summary judgment for second layer excess insurer in dispute involving E&O coverage provided by an excess liability policy on grounds that the underlying claim did not involve a “wrongful act” implicating the policy’s insuring agreement, lacked the requisite fortuity required by New York law, and was barred by the policy’s breach of contract exclusion).

- Unimax Corp. v. Continental Ins. Co., No. 2016-cv-279282 (Ga. Super. Ct. 2017) (granting motion to dismiss environmental insurance coverage action), aff’d, (Ga. Ct. App. 2018).

- Nat'l Union Fire Ins. Co. of Pittsburgh v. Roman Catholic Diocese of Brooklyn, No. 653575/2014 (N.Y. Sup. Ct. 2017) (insurance coverage dispute involving underlying claims of sexual/physical abuse, granting motion for partial summary regarding pro rata allocation of defense and indemnity costs, number of occurrences, and exhaustion of multiple self-insured retentions).

- Roman Catholic Diocese of Brooklyn v. Nat'l Union Fire Ins. Co. of Pittsburgh, 87 A.D.3d 1057 (N.Y. App. Div. 2011), aff’d, 991 N.E.2d 666 (N.Y. 2013) (summary judgment for insurers in a dispute concerning the number of occurrences for underlying claims of sexual abuse, exhaustion of multiple SIRs, pro rata allocation, and waiver under New York law).